Tổng thống Mỹ cảnh báo sẽ áp thuế 200% đối với rượu của Pháp và EU

Ngày 13/3, Tổng thống Mỹ Donald Trump cảnh báo sẽ áp thuế 200% với rượu vang, sâm panh và rượu khác nhập khẩu từ Pháp và các nước EU, nếu như khối này không dỡ bỏ mức thuế đánh vào rượu whisky của Mỹ.

Giá kim loại "anh em của vàng" tiến sát đỉnh 5 tháng khi nhu cầu tìm kiếm tài sản trú ẩn an toàn tăng vọt

Giá bạc tiếp tục tăng trong phiên thứ 3 liên tiếp lên tới 33,3 USD/ounce, chỉ kém 0,1 USD so với đỉnh 33,5 USD được xác lập tháng 10 năm ngoái.

Công ty mẹ Gojek lỗ hơn 300 triệu USD, cắt giảm nhiều ưu đãi cho tài xế, khách hàng

Giống như nhiều kỳ lân công nghệ, GoTo phải vật lộn để có lãi.

Truyền thông Indonesia: VinFast sắp đầu tư nhà máy 237 triệu USD, quan tâm mảng điện mặt trời, điện gió

Nhà máy VinFast dự kiến đầu tư sẽ được xây dựng trên diện tích 120ha, với công suất 50.000 xe mỗi năm và tổng vốn đầu tư lên tới 4.000 tỷ Rupiah, Bộ trưởng Đầu tư và Hạ nguồn Indonesia, ông Rosan Roeslani cho biết.

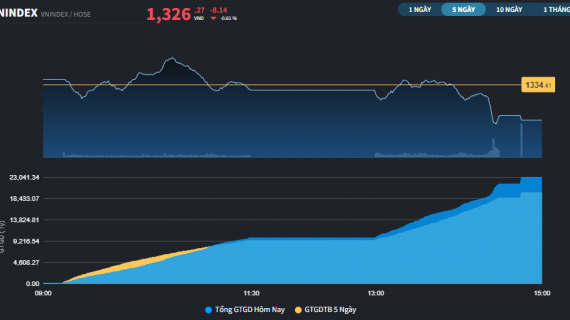

Nguy cơ bong bóng tài chính nếu 2,5 triệu tỷ đồng chảy vào chứng khoán, bất động sản

Chuyên gia cảnh báo, nếu vốn tín dụng không được đưa vào sản xuất, kinh doanh mà chảy vào chứng khoán hay bất động sản thì nguy cơ rơi vào tình trạng tăng trưởng ảo, bong bóng tài chính là rất lớn.

Bà Rịa - Vũng Tàu chấp thuận chủ trương xây tổ hợp cao 30 tầng ở phường Thắng Tam

Dự án có 30 tầng nổi và từ 1 - 3 tầng (bố trí bãi đỗ xe), mật độ xây dựng 40%, hệ số sử dụng đất 10,0 lần.